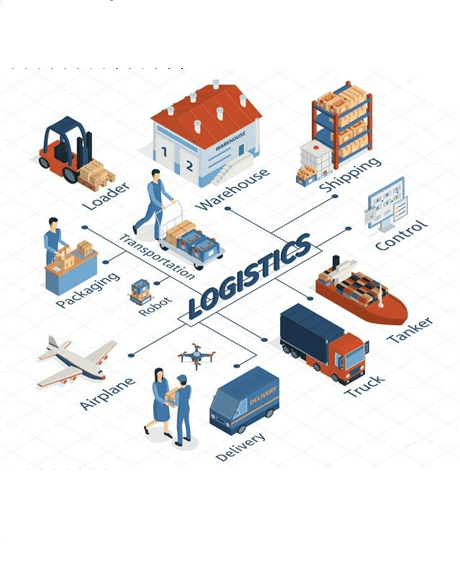

IN MANY parts of China, the warehouses and industrial parks that used to be a magnet for international investors are grappling with a surprising slowdown in business activity.

Logistics hubs that were built in anticipation of a long-lasting boom in e-commerce, manufacturing and food storage are losing tenants, forcing building owners to slash rents and shorten lease terms.

Shares of real estate investment trusts (Reits) that own China commercial properties have plummeted, and some of their managers expect their rental income to fall further.

Average vacancy rates at logistics properties in east and north China are approaching 20 per cent, the highest in years, according to real estate consultancies.

More warehouses are being built, which is making the problem worse. “We are looking at a supply glut in logistics and industrial properties in China,” said Xavier Lee, an equity analyst at Morningstar who covers the real estate sector.

The deterioration has been disappointing for property owners that were counting on an economic rebound in China this year.