ALIBABA’S plan to buy full control of its logistics subsidiary rather than spinning it off could signal the Chinese giant is taking competition from e-commerce rivals Shein and Temu more seriously in overseas markets, analysts said.

The company on Tuesday (Mar 26) said it has decided against listing Cainiao – a year after announcing its intention to list – citing reasons such as a “depressed” share market in Hong Kong.

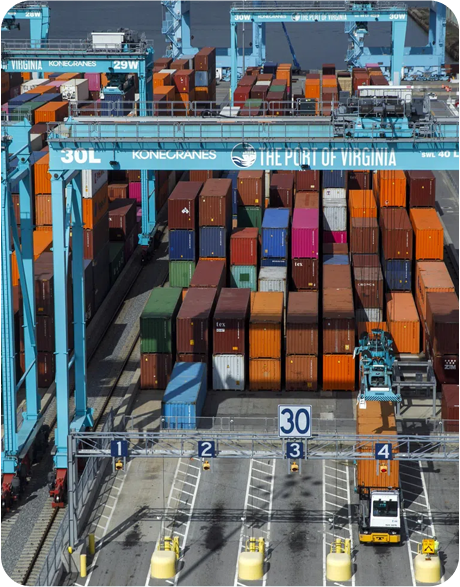

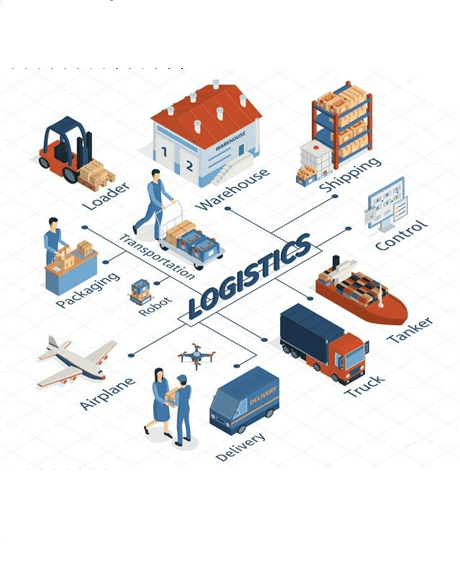

At the same time, it outlined further investment in Cainiao’s global network to reduce delivery times to three days from five for markets including the US.

The sprawling technology firm has returned focus to its core business against a sputtering macroeconomic backdrop at home and booming e-commerce market abroad. While it has solidified its No 1 rank in China, it is far from dominant overseas.

“We see a lot of players in the market being very aggressive but in the future this is going to be an even bigger market and we want to participate in that,” chairman Joe Tsai told analysts during a conference call.

Alibaba has been grappling with how to make its global marketplaces such as AliExpress and Lazada more competitive.