Tariffs have long been a contentious topic in the United States, with their implementation and effects sparking heated debates among economists, policymakers, and consumers alike. Today we will look into the intricate world of tariffs, exploring their history, purpose, and most importantly, their overall impact on American consumers. By examining various aspects of tariff policies and their consequences, we aim to provide a nuanced understanding of this complex economic tool.

The History and Purpose of Tariffs in the United States

Tariffs have been a part of the United States’ economic policy since the country’s inception. In fact, the very first significant piece of legislation passed by Congress in 1789 was the Tariff Act, which aimed to generate revenue for the newly formed government and protect domestic industries from foreign competition. Throughout American history, tariffs have served multiple purposes:

- Revenue generation for the federal government

- Protection of domestic industries from foreign competition

- Negotiation leverage in international trade agreements

- Retaliation against unfair trade practices by other countries

The use of tariffs has ebbed and flowed over time, with periods of high protectionism alternating with eras of more open trade. For instance, the Smoot Hawley Tariff Act of 1930 raised tariffs to historically high levels during the Great Depression, while the post-World War II era saw a general trend towards lower tariffs and increased global trade.

Recent Tariff Policies in the United States

In recent years, tariffs have once again taken center stage in U.S. economic policy. The Trump administration implemented a series of tariffs on various imported goods, particularly from China, in an effort to address what it perceived as unfair trade practices and to reduce the U.S. trade deficit.Some notable tariffs imposed include:

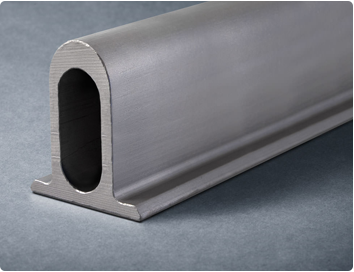

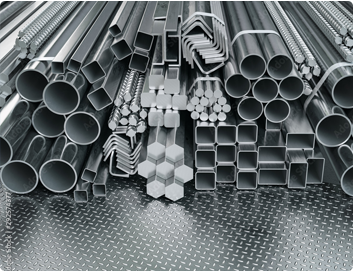

- 25% tariff on steel imports and 10% on aluminum imports from most countries

- Tariffs on $250 billion worth of Chinese goods, ranging from 10% to 25%

- Tariffs on solar panels, washing machines, and other specific products

These tariffs have had far-reaching effects on the U.S. economy and consumers, which we will explore in depth in the following sections.

The Direct Impact of Tariffs on Consumer Prices

One of the most immediate and noticeable effects of tariffs on consumers is the increase in prices for imported goods. When the U.S. government imposes a tariff on a product, the cost of importing that product rises, and this additional cost is often passed on to consumers in the form of higher retail prices.A case study of the 2018-2019 tariffs on washing machines illustrates this point:

In January 2018, the U.S. imposed tariffs of up to 50% on imported washing machines. A study by economists at the University of Chicago and the Federal Reserve found that the average price of washing machines increased by $86 per unit, or about 12%, in the months following the tariff implementation.

This example demonstrates how tariffs can directly impact consumer prices for specific products. However, the effects of tariffs often extend beyond the targeted goods, as we’ll explore in the next section.

The Ripple Effect: Indirect Consequences for Consumers

While the direct price increases on tariffed goods are relatively easy to observe, tariffs can have numerous indirect effects on consumers that are more challenging to quantify but no less significant.

Supply Chain Disruptions

Tariffs can disrupt global supply chains, forcing companies to seek alternative suppliers or relocate production. These changes can lead to increased costs and potential quality issues, which may ultimately be reflected in consumer prices or product availability.

Domestic Price Increases

Even domestically produced goods can see price increases as a result of tariffs. When foreign competition is reduced due to tariffs, domestic producers may have more leeway to raise their prices without losing market share.

Job Market Effects

Tariffs can have complex effects on the job market. While they may protect jobs in industries directly shielded by the tariffs, they can also lead to job losses in industries that rely on imported inputs or in sectors affected by retaliatory tariffs imposed by other countries.A comprehensive study by the Tax Foundation estimated that the tariffs imposed in 2018-2019 could lead to a net loss of nearly 180,000 jobs in the United States.