· US base oils price premium to feedstock/heating oil extends fall.

· Lower base oils premium puts more pressure on refiners to adjust output.

· Any downward supply adjustments would coincide with weak demand fundamentals, cutting risk of larger supply-build in coming weeks.

· Base oils premium also fell at year-end in 2022 and 2023, but US market still saw large supply-build.

· Earlier fall in US base oils prices and margins this year could facilitate moves to adjust output.

· Any such adjustment would follow signs of more limited supply-build in early weeks of Q4 2024.

· Any rise in supply-build would increase importance of open arbitrage to markets like Africa and India to clear surplus volumes.

· Moves to limit US supply-build at year-end face complications from prospect of high import volumes in Nov 2024.

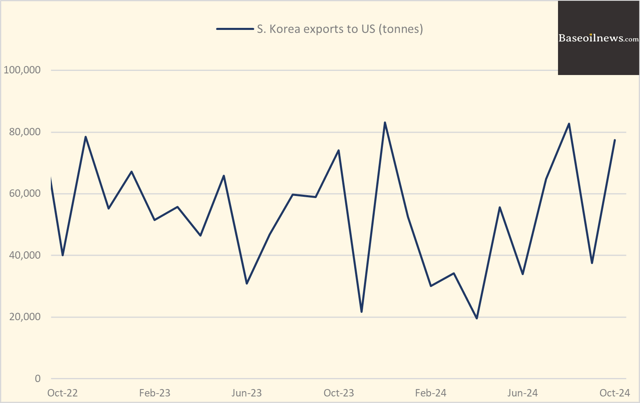

· South Korea’s base oils exports to US rise in Oct 2024 to second-highest level this year.

· Most of the supplies, as well as large volume from UAE, likely to reach US in Nov 2024.

· Rise in US base oils imports in Nov 2024 would add to pressure on suppliers to maintain even higher export volumes in response in order to avoid larger supply-build.

· Rise in South Korea’s exports to US coincides with sustained improvement in US Group III prices relative to Europe Group III prices since early Oct 2024.

· Any extension of the trend raises prospect of shipments from South Korea to US staying at higher levels.

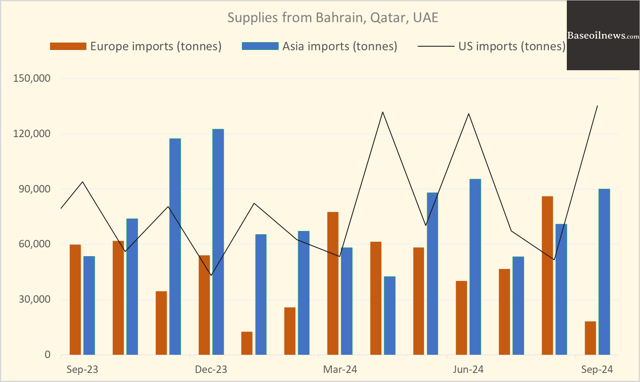

· US could attract additional shipments from UAE and Bahrain amid signs of more muted demand for their supplies in China especially, combined with weak fundamentals in Europe.

· US imports of premium-grade base oils from Middle East already surge in Sept 2024, far outpacing shipments to Europe and Asia.

· US imports rise despite domestic Group III prices holding at discount to prices in Europe and Asia at that time.

· Dynamic could point to structural change that outweighs impact of market price levels.

· Any signs of more sustained pick-up in flows from UAE and Bahrain to US would add to pressure on flow of shipments from South Korea to US.

· Any such sustained wave of shipments would likely keep pressure on Group III prices and on US refiners to maintain higher exports.

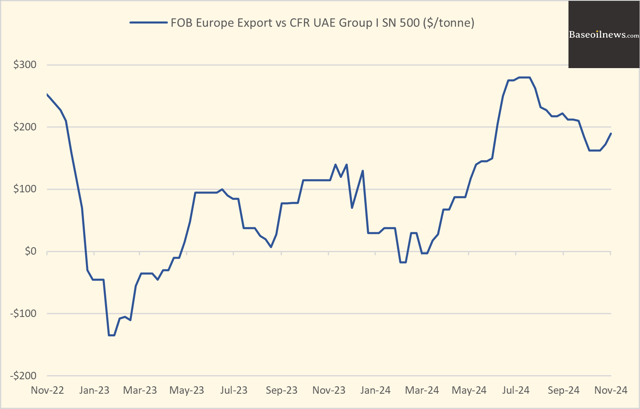

· Europe’s Group I base oils supply shows signs of staying lower than usual at year-end, and at levels that complicate moves to put together larger shipments to move to overseas markets.

· Europe Group I export prices maintain steep premium to prices in markets like Middle East, suggesting any pick-up in surplus supplies at year-end so far remains lower than usual.